by Cynthia Germain

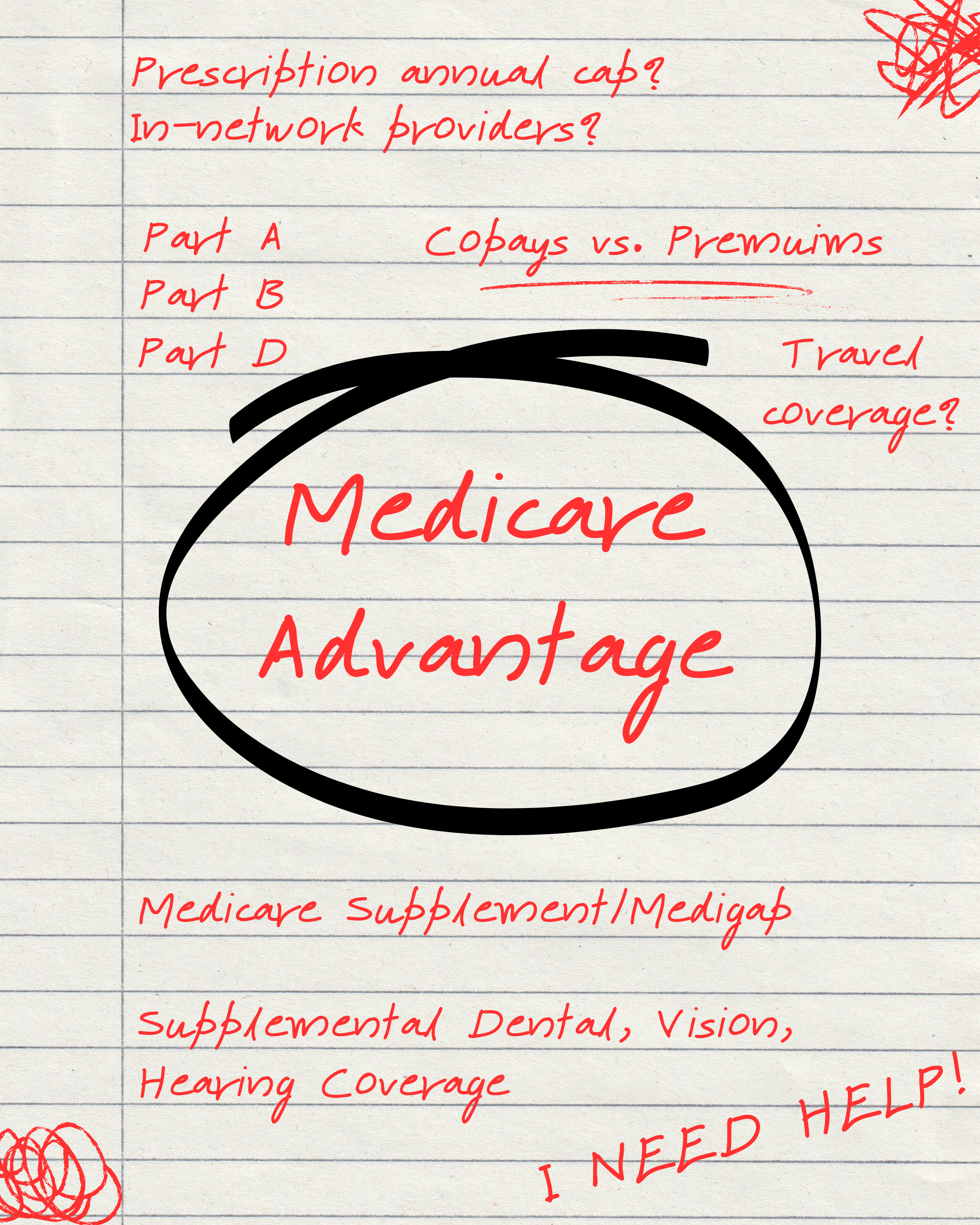

Medicare Advantage… to have or not to have? That is definitely the question right now. And is there really an “advantage” to these plans as the name suggests? If you’ve been staring at paperwork, postcards, and TV commercials recently, you’re not alone. It all feels so complex these days — what to select, which plan makes sense for your prescriptions and medical needs, and with the $2,000 annual cap on prescriptions replacing the old “donut hole,” many people are still trying to understand what their real out-of-pocket costs will be going forward.

Before going any further, a quick but important note: if you have UnitedHealthcare, there has been a major change in covered providers for 2026. If you haven’t already reviewed your coverage, now is the time. The clock is ticking toward December 7th.

When Medicare launched in 1965, it was a groundbreaking moment giving a federal guarantee of health coverage for older adults. For a long time, Medicare was pretty straightforward: Part A (hospital coverage) and Part B (medical care and doctor visits). Then healthcare got more complex and expensive. Prescription drugs skyrocketed. Private insurers entered the scene. Policies shifted as people lived longer with more chronic conditions. And slowly, Medicare grew into something that looks very different from its original form.

Today we have Original Medicare (Parts A & B), Medicare Supplement/Medigap, Medicare Part D for prescriptions, and Medicare Advantage (Part C) all-in-one plans run by private insurance companies. Each option has pros, cons, and fine print. That’s where the confusion, and perhaps some anxiety, comes in.

Choosing Medicare coverage is no longer just checking a box. It now requires thinking about:

- Prescription drugs (and whether they’re on the formulary)

- Medical providers (are they considered “in-network”)

- Copays vs. premiums

- Out-of-pocket caps

- Travel coverage

- Chronic health needs

- Supplemental dental/vision/hearing coverage

It’s no surprise that many older adults feel like they’re making a life-or-death financial decision every year. Here’s the truth that no brochure or commercial ever quite says out loud: There is no one “best” Medicare plan — only the best plan for YOU. Your lifestyle, your health conditions, your medications, your travel, your preferred doctors, and your personal risk tolerance all play a role.

A few guiding questions:

Do you need freedom to see any doctor, anywhere?

→ Original Medicare + Medigap may be better.

Are you comfortable with a network of providers and want an all-in-one plan that may include extras like dental?

→ Medicare Advantage might be a good fit.

Do your medications drive most of your healthcare spending?

→ The Part D plan is likely the most important factor.

Do you live seasonally in another state or travel frequently?

→ Some plans work well for that; others do not.

The goal isn’t perfection, it’s alignment with your real life.

Don’t do this alone. A short conversation with a trained professional can save months of stress and thousands of dollars. Your best unbiased, free resources are the Aging & Disability Resource Center, SHIP counselors, or a trusted insurance broker. Be sure you are ready to share your complete medication list, your preferred providers, your estimated travel plans, and your comfort level with change.

Let them walk you through the math and the options. This is what they do every day.

Medicare was created to support aging with dignity. While the system has gotten more complicated, the same goal remains: you deserve care that works for your life and for your future. Because when it comes to good health in later life, peace of mind matters just as much as coverage.